“Can a roofing company waive the deductible?” The question pops up while you are staring down a hefty bill of home repairs may lead you towards making an impulsive decision, especially with deductibles.

You may be wondering, ‘can a roofing company waive the deductible?’ The answer is NO, legally speaking.

But you might feel an urge to somehow lower that amount you have to pay and you may consider offers from contractors who ‘claim’ they can waive off deductibles and offer a better cost-effective repair solution.

Hey! don’t fall for that. It might sound great, but it is pretty much far-fetched from the truth and can be quite intimidating.

Let’s get into the facts that might help you from seeing yourself in jail, sorry for being so blunt but it’s in your favor.

This whole process of waiving deductibles and offering inducements on insurance is simply insurance fraud. It is illegal and offensive.

Companies who know to abide by their values will never indulge in this fraud. Moreover, businesses that do this kind of fraud use cut-rate materials and you might end up spending way more on your roof repairs than what you saved in the first place.

It’s Simply Insurance Fraud

So, you want your roof to be replaced, and you’ll definitely be contacted by contractors who advertise ‘waived’ insurance deductibles. These contractors claim to adjust insurance deductibles into materials or repair costs and save you some money.

Some may even offer discounted rates by absorbing the deductibles into their repair cost. It is problematic as much as tempting it might sound – that’s just illegal. It’s a tricky one, this whole scenario of waived off deductibles if you’re not aware enough about how insurance management. So, hang in there and read on to find everything you want to know before making this decision.

In the past, insurance companies used to write a lump sum payment check to homeowners, and the deductible was removed from the total payment. For example, a home needs roof damage repair suffered from a sturdy storm, then the insurance company will get an estimated amount of the total repair cost. If the amount is $7,000 and a homeowner had a $1500 deductible, insurers would simply sign a check for $5,500 subtracting the deductible. But, today that’s not the case.

Can a roofing company waive the deductible? Not Really!

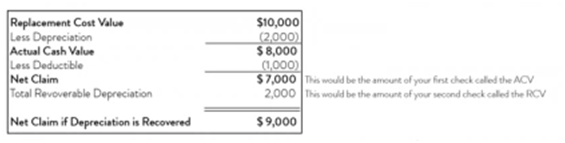

Today, almost everyone has provisions in their insurance policies known as “Replacement Cost Value (RCV)”. Instead of paying out lump-sum amounts, insurers now break down checks into multiple separate payments. Today, if a roof needs $10,000 in repairs, an insurance adjuster will deduct the $1,000 from the estimated cost of repairs. The insurance company also subtracts any depreciation value from the evaluated cost.

This results in the homeowner receiving a smaller check. A roofing company will then invoice the homeowner after the repairing service is completed. In this scenario, if a homeowner sends a bill of $10,000 or more to the insurance company, then he might be eligible to recover some of the funds from the roof’s devaluation. At last, it all comes down to the cost of the roofing service and the estimated value of the roof.

It Matters, Here’s Why

The question ‘is it illegal for a roofer to pay your deductible?’ might pop up in your thoughts while going through this whole process. Put simply, yes, the roofers who assure you to waive deductibles are simply fraudulent. That’s the conclusion after considering few reasons.

Number one, an insurance policy is at its core a contract between a homeowner and an insurer. The contract assures homeowners financial protection against damage for a yearly premium minus the deductible. The insurance company in turn is not liable to pay you a dime if you break or breach the contract.

So, that breach will happen if you hire a roofing company and try to waive the deductibles and lie to the insurance company.

How Roofers Say They Waive Deductible (by fraud)

You will probably hear them say that they will:

- Help you slip past deductible

- Waive off your deductible

- Hide your total cost from insurers

- Compensate you your deductible

- Wave your deductible if you market their company by putting signboard in your yard – that’s a clever one

How they do this (by cost-cutting and worse)

They don’t care about your deductibles; it is just a way for them to casually snitch your hard-earned money from you.

Here, is how they cover the waived deductible:

- Use cheap labor, unskilled and sloppy workers

- Just get cheaper materials for your roof damage repair

- They will cut corners and won’t use all the material thus resulting in poor quality roof

- This is what you need to be aware of, most of these cheap contractors install a new roof over the old. This can cause serious damage in future

- Most contractors are not insured and bonded

- Using stolen materials or factory seconds. Material theft is a serious problem in this industry. You have to be careful while choosing the roofers for your roof replacement.

You have to choose a legit contractor like Corey & Corey, who has been in this business for more than 4 decades now! Get yourself the service your home deserves with no fluff like waived deductions.

You might think ‘Ah, Can I deduct roof replacement?’ In any legal way possible, it is not possible unless you want to commit insurance fraud.

Don’t Fall for the Trap

I am going to get deeper into this discussion now. Let’s have a comprehensive example to understand how this works. In this example, the value of repairing the roof is let’s say $10,000. Applying the depreciation over time, the insurance company holds that amount in the account of recoverable depreciation, until the roof is replaced.

On completion, the contractor invoices the insurance company and informs them about the project completion. Then the insurance company releases the final check. This process is used to ensure that you’re getting a complete replacement and not an unfinished job. So, here’s the math:

So, in the example above, you’ll receive $9,000 from the insurance company although the work is valued at $10,000. The remaining $1,000 is the deductible, which is payable to the contractor by the homeowners.

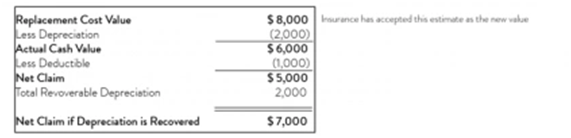

If homeowners ask for an estimate and it comes lower at $8,000, then when the contractor invoices the insurance company, the insurance people won’t be like “Good work, you did it in cheap.

Here’s your $1,000.” Instead, they will be like, “Thanks for saving us some bucks, and the calculation will be something like this:

It is evident that as long as all parties are on the same page, a lower bid only benefits the insurance company, so there’s that! It typically fails the homeowners to save some money at their end because a lot of roofers who promise waived deductions will use cheap materials and cut corners to remain profitable. It’s a rare case that roofers will truly promise to waive their deductions.

Things to Keep in Mind to Avoid Any Trouble

Here’s an extract from the legal bill just in case you thought I was making it up!

– Section. 27.02., CERTAIN INSURANCE CLAIMS FOR UNNECESSARY CHARGES.

- A person who sells or trades services or goods is committing an offense if:

- the person promises to deliver the good or service and to pay:

- part of or complete legally applicable insurance deductible; or

- a refund in monetary terms equal to all or part of any valid insurance deductible;

- the good or service is remunerated by the customer from profits of a property or casualty insurance policy; and

- the person deliberately charges an amount for the service that surpasses the usual and customary charge by the person for the good or service by an amount equal to or greater than all or part of the pertinent insurance deductible paid by the person to an insurer on behalf of an insured or remitted to an insured by the person as a rebate.

- the person promises to deliver the good or service and to pay:

- A person who is insured under a property or casualty insurance policy commits a crime if the person:

- submits a claim under the policy based on charges that violate Subsection (a) of the above section; or

- knowingly allows a claim in violation of Subsection

Bottom Line – Go for A Legit Roofer Like Corey & Corey

Stop thinking about it, the questions like ‘Can a roofing company waive the deductible?’ are troublesome and may lead you to jail. You have to be careful while choosing a contractor for your roofing. Corey & Corey has been in the roofing business for over 40 years now, we can assure you that for us, our reputation and quality of service matters the most. We pride ourselves on having one of the highest customer satisfaction ratings in the Cape Cod region.

Behind this result is our sheer effort to provide best-in-class roofing services to our clients, our industry-leading material, and our business ethics. Yes, we’re a legit and registered roofing company that won’t promise you any waived deductible, but what we do promise is a top-notch roofing service with the finest materials.

Get Rid of Roofing Issue Now

At last, I got to say that home is your prime investment. Please make sure no one does damage to your property and ensures quality workmanship is undertaken by a company with honor. If you’re looking for an authentic roofer then contact Corey & Corey Roofers or call us at 508-775-8240 for a free estimate. We don’t cut corners or use cheap material. We’re here only to make you feel good about your home!